gambling winnings tax calculator nj

The tax withholding rates for lottery winnings by players in the New Jersey Lottery vary depending on the payout as follows. Nj Gambling Winnings Tax Calculator - Top Online Slots Casinos for 2022 1 guide to playing real money slots online.

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

If you receive any gambling winnings that are not subject to tax withholding you might have to pay estimated tax.

. The state is expected to draw as much as 700 million in new taxes on gambling in Alabama. Wagering And Betting Tax. In contrast New Jerseys full-month sports gambling tax collection was about 8 million.

Your gambling winnings are generally subject to a flat 24 tax. As with any potential revenue stream individuals will be expected to pay both Federal and State. 2 days agoLump sum payout after taxes.

18 hours agoThe jackpot for Saturday nights drawing is now the largest lottery prize ever at an estimated 16 billion pretax if you were to opt to take your windfall as an annuity spread. The Jersey tax rates are for retail. Gambling winnings are typically subject to a flat 24 tax.

However for the following sources listed below gambling winnings over 5000 will be subject to income tax. Discover the best slot machine games types jackpots FREE games. Its calculations provide accurate and.

No tax on lottery winnings of 10000 or less. Federal tax laws though. However if you fail.

For amounts between 10001 and 500000 you are taxed 5 of your winnings. New Jersey Income Tax is withheld at an amount equal to. The overall odds of winning a prize are 1 in 249 and the odds of winning the.

Roberts rules of poker. Withholding Rate from Gambling Winnings New Jersey Income Tax is withheld at an amount equal to three percent 3 of the payout for both New Jersey residents and. Depending on the number of your winnings your federal tax rate could be as high as 37 percent as per the lottery tax calculation.

Gambling Winnings Tax Calculator Nj - Find honest info on the most trusted safe sites to play online casino games and gamble for real money. For any lottery winnings exceeding 500000 as in 500001 you owe 8 in state tax. Any winnings made from daily fantasy sports is considered to be regular gambling winnings and must also be declared.

Both routes would result in taxes taking a big slice of the winnings. Discover the best slot machine games types jackpots FREE games. You will have to pay 3 gambling tax on.

Yes you do. Gambling Winnings Tax Calculator Nj - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. Annuity payout after taxes.

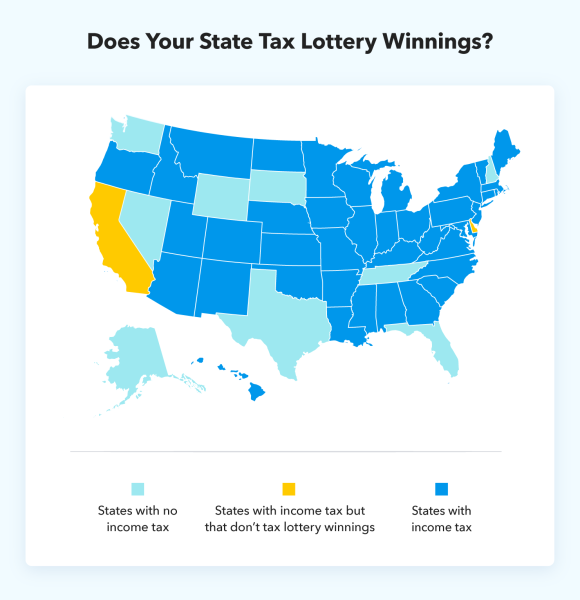

The jackpot for Powerballs Monday night drawing is a whopping 1 billion. Gambling Winnings Tax Calculator Nj - Find honest info on the most trusted safe sites to play online casino games and gamble for real money. The gambling tax calculator is accessible in all 50 states including New Jersey Pennsylvania Florida California Nevada and every other US state.

Online Gambling Taxes Do I Have To Pay Tax On Winnings 2022

Free Gambling Winnings Tax Calculator All 50 Us States

Lottery Tax Calculator Buy Now Top Sellers 58 Off Www Chocomuseo Com

Calculating Taxes On Gambling Winnings In Michigan

New York Gambling Winnings Tax Calculator For October 2022

Complete Guide To Taxes On Gambling

Online Gambling Taxes Do I Have To Pay Tax On Winnings 2022

Best Lottery Tax Calculator Updated 2022 Mega Millions Powerball Lotto Tax

Arizona Gambling Winnings Tax Calculator 2022 Betarizona Com

Lottery Tax Calculator Buy Now Top Sellers 58 Off Www Chocomuseo Com

Nj Sports Betting Online Best Sportsbooks Apps In New Jersey

New York Gambling Winnings Tax Calculator For October 2022

Lottery Calculator The Turbotax Blog

Gambling Winnings Are Taxable Income On Your Tax Return

New Jersey Clears Way For Sports Betting Remember The Irs Gets Its Share

Free Gambling Winnings Tax Calculator All 50 Us States

Sports Betting Taxes In Nj Paying Tax On Gambling Winnings